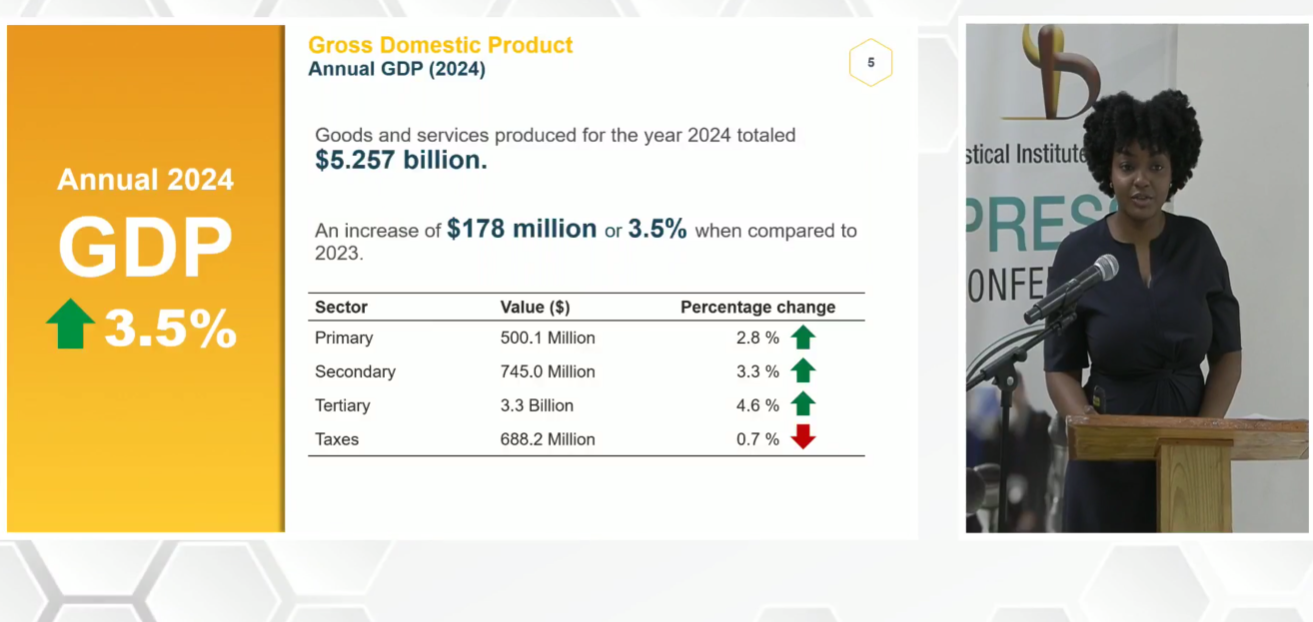

On Wednesday, September 24th, the Statistical Institute of Belize (SIB) presented its review of the country’s Gross Domestic Product (GDP) for 2024, reporting a modest growth of 3.5%.

The end-of-year data highlighted strong performance in the agricultural sector. SIB’s Manager for the Economic Statistics Department, Jacqueline Sabal, noted that the primary sector grew by 2.8%. “This was mainly due to recovery from unfavorable weather conditions experienced in the previous year,” she said. The secondary sector, which includes manufacturing, electricity, water, and construction, expanded by 3.3% due to improved performance across all industries and the introduction of a local cement-producing factory.

Sabal further explained that the tertiary sector, covering accommodation, food services, financial, and insurance services, recorded the most significant growth. “It reported growth of 4.6%, and this was the result of an increase mainly in accommodation and food services,” she said.

The SIB’s findings contradicted Prime Minister John Briceño’s report during his State of the Nation Address on September 16th, when he stated that Belize’s GDP growth for 2024 was 8.2%. Sabal clarified the discrepancy. “This discrepancy is due to the fact that the annual GDP is based on a more comprehensive data set,” she explained. “For the quarter, we only use volume indicators. When the annual comes around, we have more access to financial reports, revenue data, etc.”

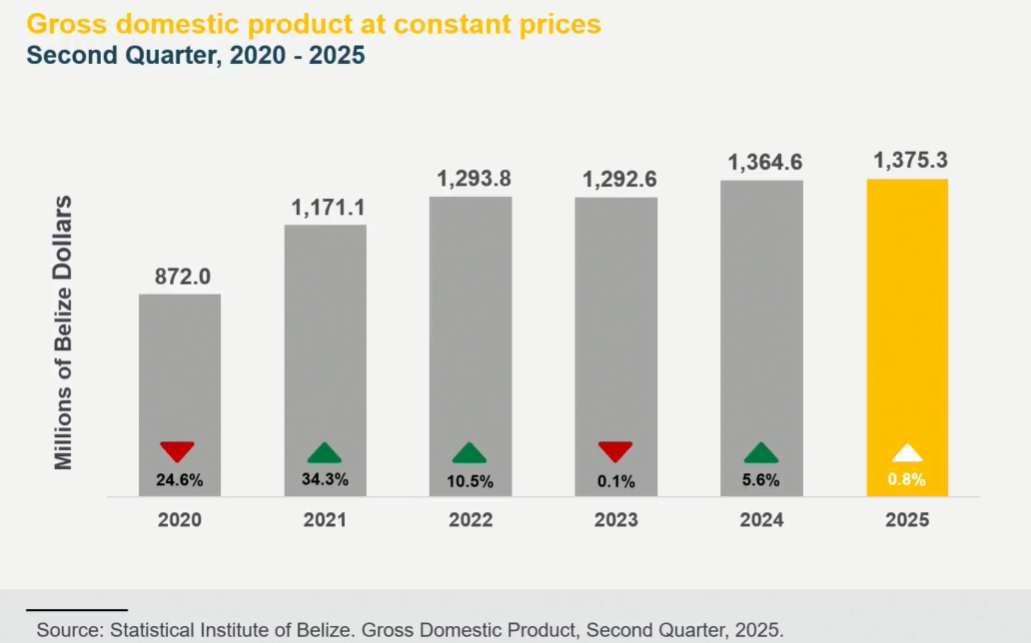

Looking at the first quarter of 2025, Sabal reported sluggish growth of just 0.8%, mainly driven by the primary and secondary sectors. “Banana production rose by 20.4% from 23.7 to 28.5 thousand metric tons in the second quarter of 2025,” she said. “Citrus was up by more than two-thirds, from 6.1 to 10.4 thousand metric tons. Livestock grew by 9.9%, supported by increased production of cattle by 10.4%, pigs by 15.2%, and poultry by 8.1%, which were driven by favorable export prices and consistent domestic demand.”

However, wholesale and retail trade had the most negative impact, alongside declines in electricity, taxes, public administration, and other service activities. Sabal noted that this marked the first decline in the tertiary sector since early 2021. “The primary drivers of this decline were the wholesale and retail trade industry, which fell by 5% due to a decrease in the importation of goods. Transport services were down by 4.4% due to a decrease in passenger transport, and public administration decreased by 2.8% because of reduced government recurrent expenditure.”

Tourism also contributed minimally during the second quarter. “The contribution of tourism for this quarter was very small. It’s a slow season for quarter two, so we did not have a lot of visitors,” Sabal explained. She added that while overnight visitors decreased, cruise ship arrivals saw a slight increase.

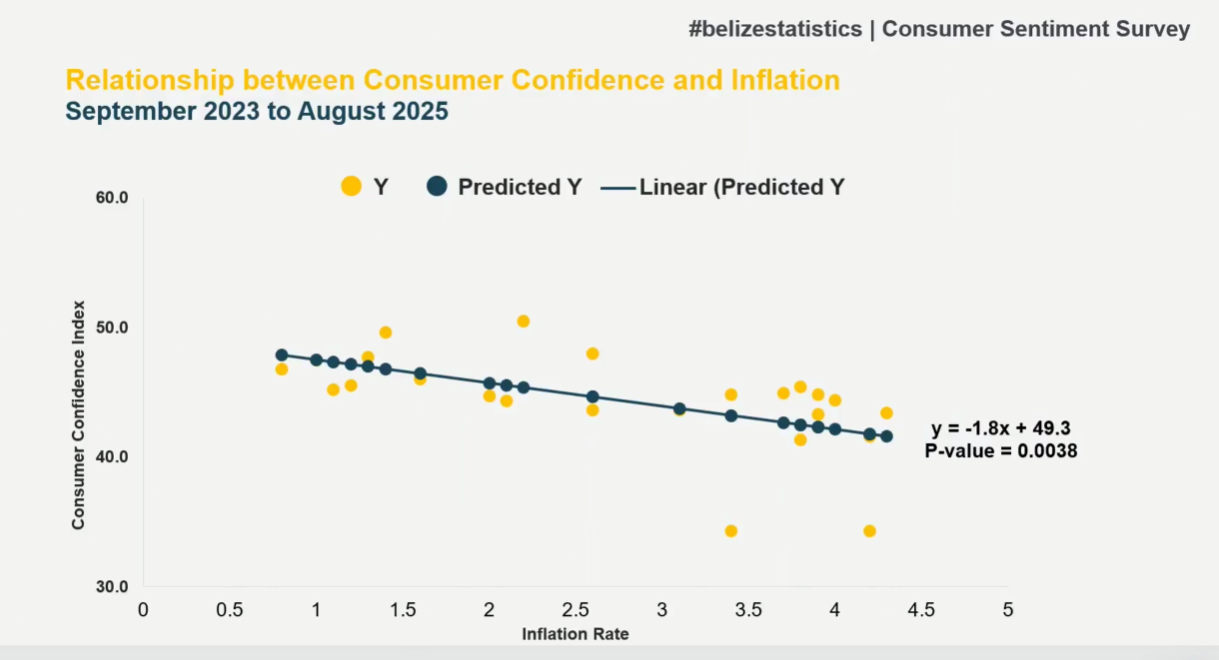

Looking ahead, SIB introduced a new metric, the consumer confidence index, which is showing negative trends. Statistician Juan Blanco reported that consumer confidence has been declining since the start of 2025. “This can also be interpreted as an early indicator of economic activity for the year 2025. As prices increase, consumer confidence declines,” he said. Blanco noted that this results in reduced consumer spending, which in turn signals weaker GDP growth. “We are currently still in the range of pessimism,” he added. “With this information, you can see where economic growth is likely to fall, which is not very high since people are feeling pessimistic.”

Share

Read more