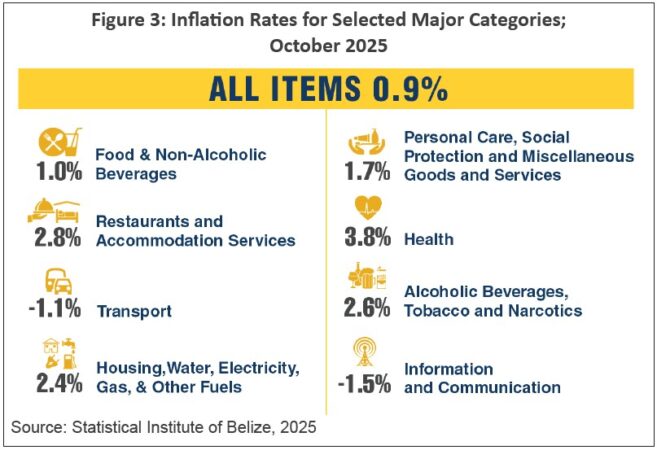

On November 26th, the Statistical Institute of Belize (SIB) released its October 2025 Consumer Price Index (CPI) and Consumer Confidence Index (CCI), showing modest inflation alongside slightly weaker household sentiment nationwide. The all-items CPI reached 120.7, up from 119.7 a year earlier, while the CCI stood at 45.2, below the neutral 50 mark and down from 45.7 in September. The data cover all six districts, including San Pedro, which saw a 2.1% inflation rate, and provide a snapshot of how Belizean households are experiencing current economic conditions.

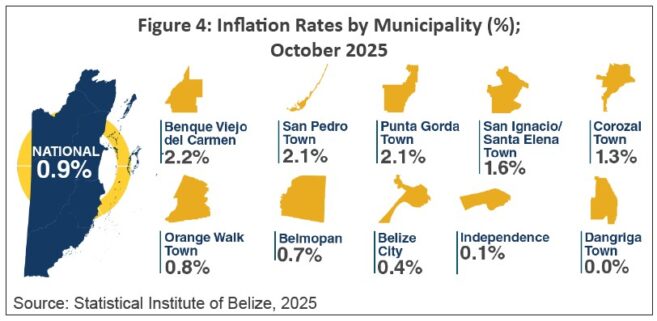

The 0.9% inflation rate in October was driven mainly by higher home rental costs, an 11.0% jump in liquefied petroleum gas prices, and rising food and non-alcoholic beverage prices. These increases were partially offset by lower prices for motor fuels and some communication equipment. At the same time, overall consumer confidence fell by 1.2% month on month, mainly because households felt worse about present economic conditions, even as expectations for the next 12 months and willingness to make major purchases showed slight improvement. SIB’s figures suggest that while Belizeans are bracing for higher living costs, they remain somewhat hopeful about the medium term.

These October readings continue trends observed throughout the year, with modest but persistent increases in key categories such as food, housing, restaurants, and personal care. Year to date, inflation for the first ten months of 2025 stood at 1.2%. Food and non-alcoholic beverages rose by 1.9%, while housing, water, electricity, gas, and other fuels increased by 2.4%, while transport, information, and communication registered price declines. On the confidence side, the national CCI has generally trended downward since January, with notable decreases among younger adults and in some districts. However, pockets such as Orange Walk and specific age groups have shown improving sentiment.

According to SIB statisticians, a CCI below 50 reflects more pessimism than optimism. October’s decline was driven by an 8.8% drop in the “Present” sub-index to 40.5, even as the “Expectations” and “Durable Goods” sub-indices rose. Rural consumers reported slightly higher confidence than urban households, and men remained somewhat more confident than women, who reported a sharp fall in their view of present conditions despite stronger attitudes toward making big-ticket purchases. District results were mixed, with Toledo experiencing a double-digit drop in confidence and Orange Walk showing the most substantial monthly improvement.

The combination of rising essential costs and subdued confidence suggests that household spending may remain cautious in the months ahead. Higher LPG and rental prices could pressure lower- and middle-income families, even as lower fuel and communication costs offer some relief. SIB’s indicators point to a fragile but possibly stabilizing outlook, with consumer sentiment likely to respond quickly to any shifts in employment, incomes, or the cost of basic goods.

Share

Read more