In an effort to avoid a chaotic default early in 2017, the Government of Belize (GOB) is urgently trying to restructure its billion-dollar debt arrangement, a Superbond that expires on 2038. A three-man team comprised of Prime Minister and Minister of Finance Right Honorable Dean Barrow, Financial Secretary Joseph Waight, and Economic Ambassador Mark Espat travelled to New York City, USA where they met with GOB’s legal and financial advisors. From Monday November, 7th to the 12th, the group met with key personnel from Citigroup Global Markets Inc., Cleary Gottlieb Steen and Hamilton LLP, in order to work on a new round of negotiations to ease payments on the debt.

The Belizean Government urged bondholders to form a creditor committee before the end of November to agree to a restructuring of the debt. This amendment on the Bond, sought the reduction of Belize’s public debt expense through lower interest rates. Another suggestion tabled to the advisors was the possibility of extending the life of the Superbond beyond the expiration date of 2038.

However, despite the fact that the country is currently experiencing serious financial difficulties, it must meet external debt payments. The next payment to the Superbond is due on February 2017, and even though the amount to be paid is considered to be lower than the first scheduled, it is hoped that a restructuring happens as soon as possible in order to secure this guarantee. The estimated payment due early next year is $84,950,234 BZ. It is expected that if a re-opening and extension of the Bond is achieved, it would ease the tension on the Government in terms of long term lower payments.

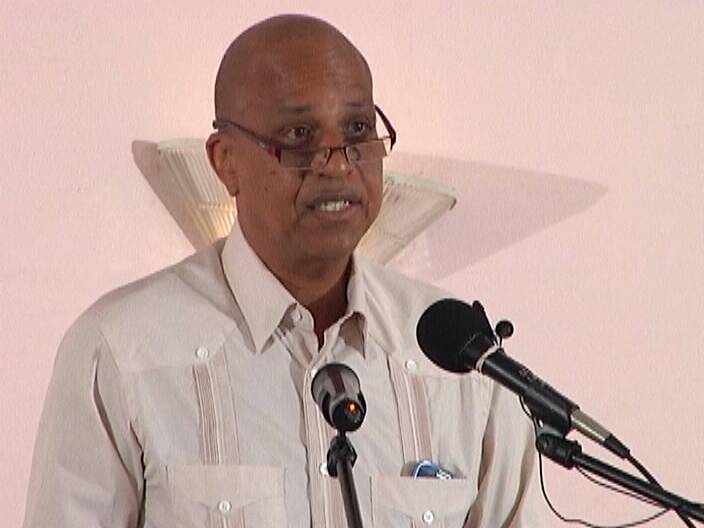

On Saturday, November 12th, the Government trio returned to the country and gave a brief explanation as to what happened in New York. According to Prime Minister Barrow, the meetings in the USA were preparatory before notifying bondholders and the public what it is expected of the restructuring. “We have agreed on our strategy and now it is a matter of actually engaging the bondholders in face-to-face negotiations,” said Barrow, who further indicated that a successful restructuring will absolutely guarantee sustainability.

The other member of the negotiating team, Espat, is tasked with directly meeting with the bondholders. He informed the local media on three possible outcomes from those important upcoming meetings. “There is the coupon rate, which is the interest rate being paid, then there is the time when the principal repayment is supposed to start, which at this present time is August 2019. Then we have the ultimate maturity, which is scheduled at this time for 2035,” said Espat.

He refrained from discussing what numbers would be proposed to the bondholders. “It would be premature at this point to disclose that,” said Espat. “In terms and conditions of the Bond, we have an obligation to consult with bondholders and to confer with a creditor committee when it is formed. We hope that a committee is formed in the coming days.” He added that Belize will go into the negotiations with the bondholders in good faith, with the ultimate objective to ensure long term sustainability.

However, with the proposed restructuring of the existing debt, there is a concern of a possible increase in taxes for the upcoming fiscal year. Barrow elaborated: “We have made no secret of the fact that there will have to be a degree of fiscal consolidation…So there is going to have to be a tax restructuring as well as a bond restructuring exercise that we will need to undertake, that we have already started on.”

The leader of the Opposition, Honorable John Briceño weighed in on the issue of national interest. Briceño blames the current administration for squandering multiple opportunities to fix the state of affairs through sustained economic growth. He cited the takeover of Belize Telemedia and the expending of the PetroCaribe funds as examples of Barrow’s mismanagements. “The Petrocaribe money saved the Prime Minister from increasing taxes about two years ago,” said Briceño. That influx, of $375 million dollars, gave him a little bit of breathing space, because we knew it was coming.” He also warned about the increase of taxes and possible retrenchment for the upcoming fiscal year. “The Prime Minister knows that he will have to do the inevitable, he will have to raise taxes and cut expenditures,” said Briceño. “Cutting expenditure will mean lowering salaries and holding on to the amount of monies they are spending in the economy, which will create a bigger problem.” Briceño did indicate that he hopes that the Superbond restructuring is successful and that the payments for the external debts are reduced. He believes that if that is achieved, the Government can then use those extra funds to invest in the Belizean people, which will create jobs, benefit the economy and combat crime and poverty.

In the upcoming weeks, the restructuring process is expected to begin after the formation of the creditor committee. But even as the restructuring begins, Belize’s credit rating has dipped from a grade B to a CCC+ by Standards and Poors global ratings. This is a very poor grading of the country’s economy, as it cites the inability to meet debt obligations.

Another cause for concern is Belize’s 2:1 exchange rate peg with the U.S dollar being affected. The Central Bank of Belize announced a couple weeks ago that the country’s foreign reserves were currently around $US315 Million. But it is known that the international benchmark for exchange rate sustainability requires Belize to keep its foreign reserves at $US300 Million and above. Falling below this benchmark will result in the Belize dollar being devaluated.