The COVID-19 pandemic has significantly affected the flow of foreign exchange into Belize, and in order for local financial institutions to effectively and efficiently continue providing their services, banks have been forced to place restrictions on the use of credit cards. These restrictions limit credit card holders on the amount they can use monthly, and priority is being given to the importation of essential needs. On the other hand, the government assures Belizeans that the reserves at the Central Bank are good enough for the rest of the year.

The pandemic’s effect on the Belizean economy intensified after March 23rd, when the Philip S.W. Goldson International Airport, along with the other official entry points to the country were closed. The earnings of foreign exchange came to a halt. As it is the norm, many Belizean businesses make purchases online for the products they provide, and these require foreign exchange.

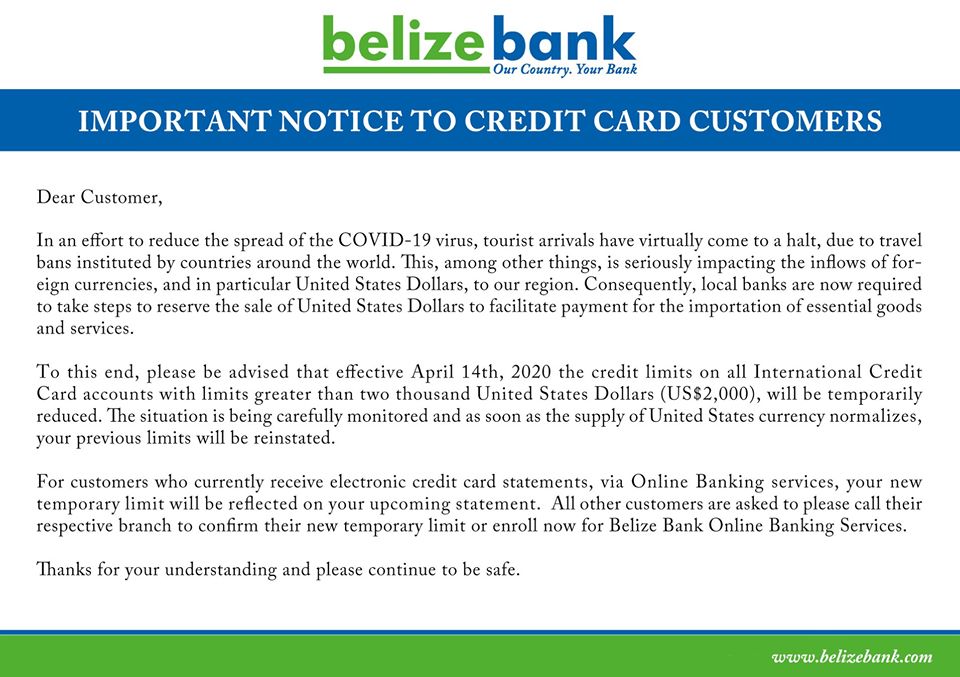

To further secure their reserves, the Belize Bank Ltd. is known to have been one of the first financial institutions to place restrictions on the use of credit cards in April. The announcement posted on their social media account says. ‘Further to our Customer Notice advising you of the temporary reductions in credit limits for international credit cards accounts, we would like to clarify that you can only repay the balance on your Credit Card once during the payment cycle. Also, please be reminded that your monthly purchases/usage is limited to a maximum of your approved credit card limit during your payment cycle.’ Speaking to a representative of the bank, they told The San Pedro Sun that this norm will be in place until further notice.

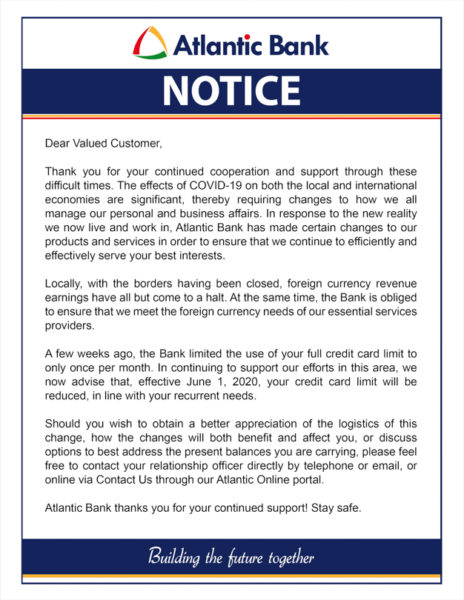

Atlantic Bank Ltd. (ABL) has also placed restrictions on the usage of credit cards, announcing in May that the usage of the full credit card limit could only be done once a month only. However, as of Monday, June 1st, the bank said that credit card limits will be reduced, in line with the recurrent needs of the cardholder. Via a notice sent to clients, ABL said this was necessary for them to continue effectively serving their clients’ best interests.

Atlantic Bank Ltd. (ABL) has also placed restrictions on the usage of credit cards, announcing in May that the usage of the full credit card limit could only be done once a month only. However, as of Monday, June 1st, the bank said that credit card limits will be reduced, in line with the recurrent needs of the cardholder. Via a notice sent to clients, ABL said this was necessary for them to continue effectively serving their clients’ best interests.

Some members of the business community on Ambergris Caye shared with The San Pedro Sun that these new regulations affect their importations to some extent. However, they also understand that the country is trying to hold on to their reserves and stretch them as much as they can because foreign exchange is non-existent at the moment.

Prime Minister weighs on the issue of foreign exchange

On Friday, May 29th, Prime Minister Right Honourable Dean Barrow, told the media via a virtual press conference that to his knowledge, banks in Belize can go for another couple of months before their foreign exchange starts to run out. According to him, when and if that happens, the other option will be to turn to the Central Bank of Belize and start using its reserves.

Barrow was very optimistic saying that his administration is working on a plan on how to attract foreign exchange from abroad. “I assure you in the most transparent and sincerest fashion as possible that we do have a plan,” said Barrow. The prime minister also assured the nation that the country’s foreign exchange reserves are more than enough at this time.

“I can say that there is no way the country will completely run out of foreign exchange, no way even close to that before the end of the year,” said Barrow. He added that during this window of time, the tourism industry could restart, and the government can also focus in making a push to stimulate other productive sectors like agriculture.

While the government continues to be optimistic that Belize will get through the COVID-19 pandemic, which has destroyed its main foreign exchange earner-tourism, the World Tourism Organization has predicted bad news for tourism this year. According to a report published on May 7th, it was estimated that international tourism numbers could fall 60-80% in 2020. Although, recovery is being foreseen by the final quarter of this year, experts, particularly in the Americas, are the least optimistic, but hoping for a favourable change in 2021.