The Belize Bank Limited was granted an injunction to temporarily prevent the Central Bank of Belize (CCB) from implementing the Revised Practice Direction No. 7 – Regulation of Fees and Charges (PD No. 7). This regulation change was supposed to be implemented on January 2, 2024, and would regulate fees imposed by domestic banks on customers. However, with the injunction, PD No. 7 is blocked until court proceedings conclude. The Supreme Court granted the injunction and will have a judicial hearing on February 12, 2024, before Justice Nadine Nabie.

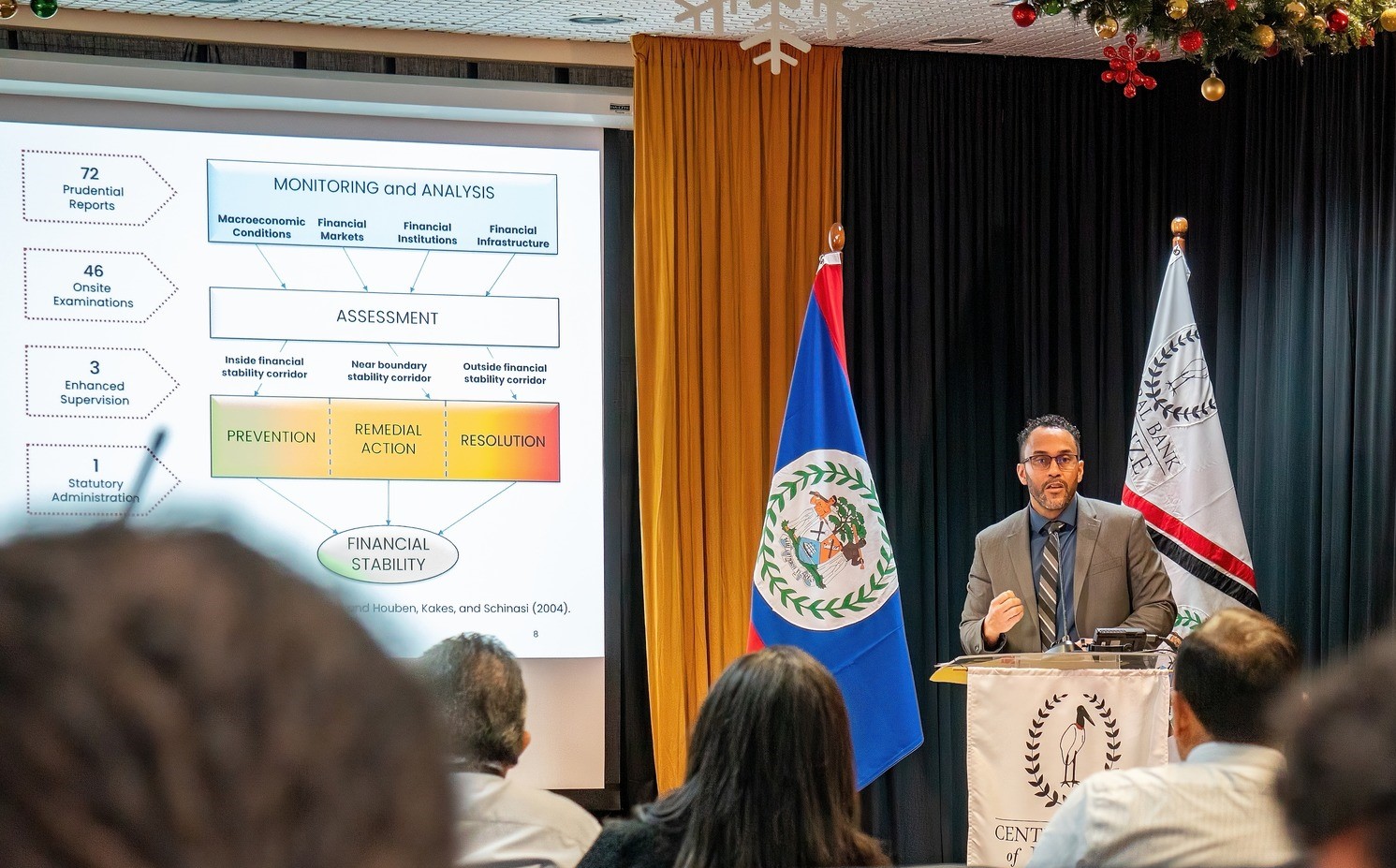

According to CCB, PD No. 7 was first presented during the quarterly press briefing on December 19, 2023. CCB can exercise power under Section 9 of the Domestic Banks and Financial Institutions Act, which is aimed at standardizing fees charged to customers at all domestic banks. PD No. 7 would restrict charges to $0.00 on dormant accounts, account closures, salary release/cancellations, savings account maintenance, transfers within the same bank, loan payment waivers, and capping own network ATM withdrawal fees to a maximum of $0.25 per transaction.

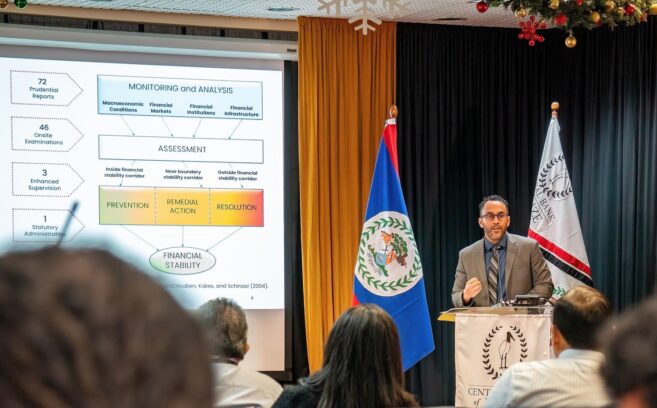

“Our goal is to enhance financial inclusivity by reducing barriers and fostering a fair and ethical financial system,” said CCB Governor Kareem Michael during a press briefing. He reiterated the “unwavering commitment to promoting stability in monetary and financial systems, ensuring Belize’s well-being through strategic oversight, modernization, and inclusive financial practices.”

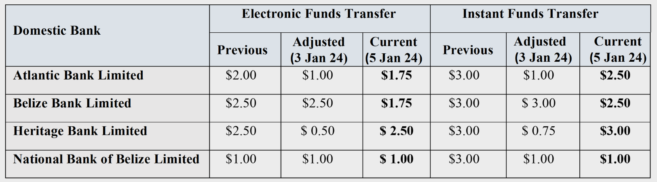

CCB also pledged to further stimulate online transactions by eliminating its existing fees to domestic banks, previously set at $0.25 for electronic funds transfers (EFT) and $0.50 for instant funds transfers (IFT) processed through the Automated Payment and Securities Settlement System (APSSS).

Even though PD No. 7 will not be implemented as previously scheduled, CCB is proceeding with the changes to EFT and IFT. Since January 3, 2024, CCB no longer charges domestic banks, except the National Bank of Belize Limited, for EFTs and IFTs processed through the APSSS. The new charges are as follows:

Many Belizeans claim Belize Bank has the highest fees compared to other domestic banks. In January 2016, Belize Bank implemented a direct teller cash withdrawal and an ATM cash withdrawal fee of $1 and $0.50, respectively. Many customers were not happy as other banks did not have similar charges. At that time, Marketing General Manager Shakira Tsai told The San Pedro Sun that “these fees were introduced to allow us to provide a higher level of our over-the-counter customer service to all our customers as well as provide the most convenient, accessible and reliable ATM service in Belize. It is based on a ‘user pay’ philosophy. We also recognize that customers have a number of choices when it comes to using their cash held on deposit at the bank. To avoid the over-the-counter fee, customers can use the ATMs for a reduced fee. If the proceeds being withdrawn are to pay for goods and services, our free Visa Debit Card can be used for these purposes at no cost.”

CCB maintains that it will continue to promote the importance of transparent and fair banking practices. They encourage customers to review their transaction statements and contact their respective banks for further clarification on the revised rates.

Belize Bank stops the Central Bank of Belize’s attempt to regulate domestic banking fees

Share

Read more