Focused on global asset protection and investment with a particular concentration on Belize, Caye International Bank Chairman Joel Nagel and ECI Development CEO Michael Cobb hosted a variety of speakers at the 25th annual President’s Week Conference from November 13-17, 2021. These speakers addressed an intimate gathering of accredited guests and discussed a wide range of interests both in person and virtually. They included Ron Paul, Porter Stansberry, Paul Rosenberg, Eryka Gemma, Carter Clews, Christopher Braun, Darlene Hart, Maurice Glazer, Jamie Alleyne, and Kirk Chisholm in addition to hosts Joel Nagel and Michael Cobb themselves as well as many others.

Since its beginning on the sandy shores of Ambergris Caye, Belize in 1997, President’s Week has been an excellent opportunity to present vital investment and asset protection information to those seeking to preserve their wealth for generations to come. As chairman of Caye Bank International, based in San Pedro Town, Belize, Joel Nagel has curated a gathering that brings together some of the most brilliant minds in one room, sharing information from both the presenters’ side of the podium to the accredited guests who make the trip to learn and share their own insights. ECI Development and its CEO Mike Cobb have been an integral part of this event, instrumental in the promotion of Belize and the greater Latin American region as the ideal overseas investment opportunity for those seeking alternate ways to create and generate wealth.

The conference continues to deliver a range of answers to challenges faced by business owners, entrepreneurs, and accredited investors.

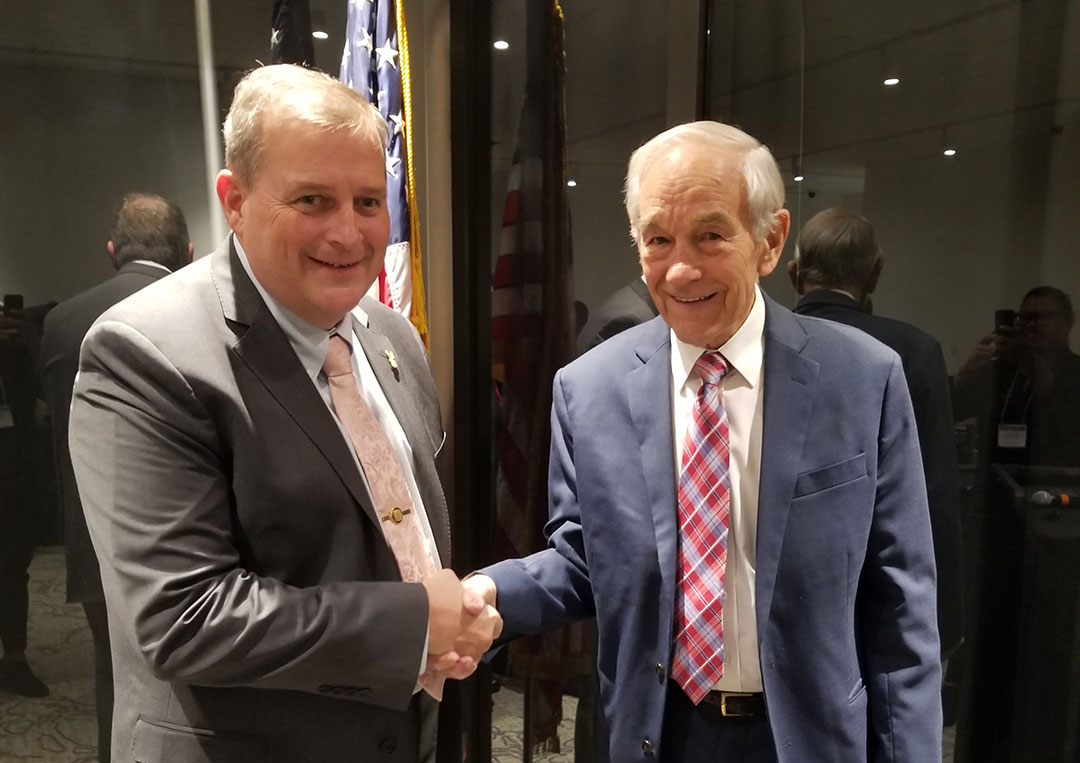

2-time US Presidential Candidate Ron Paul as Keynote Speaker

A highlight of the event was speaker Dr. Ron Paul—author, activist, and two-time presidential candidate. Dr. Paul was enthusiastic in addressing the intimate gathering, whom he heralded for holding steady to their beliefs. He spoke at length of his initial economic interest that led to a storied political career. “The real sham about money is the promise…believing that fiat money works. Fiat money doesn’t work. It serves one group of people against the other group. If you have a fiat system, [printing] money out of thin air and diluting its value, wealth is distributed unevenly. The wealthy get wealthier, and the poor get poorer…and guess what, the middle class gets wiped out!”

Dr. Paul also touched on a variety of issues that have been affecting the lives of citizens in the US, from protests and infringement on freedom to the economic and social issues stemming from the Covid-19 pandemic. He also answered questions and shared his knowledge on a variety of investment issues, particularly as they relate to new tax bills being tabled. After an incredibly down-to-earth, intimate discussion, there was a book signing that led to a dinner where guests were able to share a few words one-on-one with the distinguished former politician.

Tax Compliance Under Upcoming Changes to Rules and Regulations

In his presentation on “Tax Reform Highlights”, Christopher K. Braun, Esq. called on attendees to mentally prepare themselves. “There’s challenging times coming ahead. These tax bills are huge, they are significant…they’re going to change America and we have got to get our heads around it.” He was of course referring to President Biden’s Build Back Better Bill that is currently awaiting approval by the congressional budget office. Braun shared that he read over 10,000 pages of information to be able to provide attendees and clients as close to a breakdown of the bills as possible.

Declaring the Biden Bill as a ‘tectonic’ shift in the system, he provided clear examples of such changes, including estate and trust taxation (which will see massive capital gains taxes no matter the method of transfer), as well as overseas income taxes. Both are of interest to many looking to preserve their current wealth and seeking to grow their legacy in the years to come. He also broke down the proposed Net Investment Income Tax and the many ways it could affect small businesses and entrepreneurs.

Darlene Hart, Founder of US Tax & Financial Services, spoke of her experience as a consultant to international clients. The business involves US tax advice and planning as well as compliance services for individuals, partnerships, corporations, trusts, and estates around the world.

Around nine million Americans live around the world (outside of the US) and they need bank accounts – they are investing. Hart reiterated the significance of the fact that some nine million Americans living around the world are subject to both US income and US estate tax on their globally held assets. Her work as a consultant also involves preparing clients for changes in global tax legislation, particularly as it relates to US tax laws and changes. Part of the incoming trends in global tax legislation include the proposed 15% minimum corporate tax rate by the G-7, the requirement for corporate entities to register actual owners, and even capital gains/losses using bitcoin! She also disclosed that the IRS is looking to outsource collections to a third party, which means penalties cannot be abated.

Focused on Liberty as Well as Creating Businesses and Adding Value

“You always want to surround yourself with good people, and I feel like Joel Nagel has really curated a group of awesome people,” said speaker Eryka Gemma, Venture Director, Blockchain Fund. “One of the best parts about being here is just being surrounded by minds that are liberty-focused but also creating businesses and adding value to the economy in a way that makes them understand they need to preserve their wealth for generations to come.”

Eryka herself led a spirited discussion on bitcoin and how cryptocurrency is shaping the financial future. Joining her call to look to crypto was Paul Rosenberg, who kept the audience enthralled with his ability to discuss a range of topics. “I wanted [attendees] to understand what bitcoin is and what it does and why it is important for us. Bitcoin…energizes and empowers us,” said Rosenberg. Additionally, he hoped that those in attendance, and ultimately everyone should understand that they have a right to live according to their own values. This philosophy runs in line with the core reasoning behind the creation of bitcoin and cryptocurrency and drives its enthusiasts. “As probably one of the younger people in this room, being able to teach an older generation about something I’m passionate about, but will also help them reach their goals? I love it! I love looking to the crowd and seeing the minds of people who are super intelligent and also are looking for these wealth preservation strategies,” exclaimed Gemma.

Porter Stansberry, another notable speaker at the event, was engaging and thought-provoking as he led his presentation on “Twenty Years of Capital Efficient Investing.” He shared personal accounts of “accidental” wealth growth via new ideas, including investing in geothermal energy before cryptocurrency had its sudden growth and before mining energy needs catapulted. Over the years, through Stansberry Research, Stansberry has been providing thousands with invaluable information on stocks, markets, and investment strategies that have paid off significantly. He reminded everyone in the conference, however, that you can never go wrong with steady stocks – capital efficient investing. The McDonald’s, the Hershey’s Chocolate, the Coca Cola – these stocks continue to grow steadily and will always generate and grow wealth for those who own it. In terms of wealth preservation and efficiency, Stansberry said, one could never go wrong holding on to these investments.

Joining in the call to maintain and preserve wealth over growth was Kirk Chisholm. With his presentation titled “Financial Resilience: Secrets from the Wealthiest Man in the Roman Empire”, Chisholm hoped attendees were able to walk away thinking differently and better, and have a better decision-making process when investing. Chisholm is a Wealth Manager and Principal at Innovative Advisory Group, and a renowned Money Tree Investing podcaster. He also discussed risk management, as far more people focus on performance and not on managing risk. “Some of the smartest investors out there have said, it’s not about managing performance and more about managing risk,” said Chisholm. For many in attendance, the event was about protecting assets and investments, and he drove home the fact that “It is about keeping what you have, more than growing it.”

Maintaining said wealth in light of the various taxes and strategizing the best way to maintain personal, hard-earned assets for generations to come, there were many strategies discussed, including offshore banking, Plan B residences, and overseas property in reliable locations such as Belize as well as generational wealth investments in Teak.

Global Citizenship and Overseas Property Ownership and Investments

Jamie Alleyne, Managing Partner at Blue Marble Citizens, Inc based in St. Lucia, reiterated the idea of genuine freedom. “I really believe in the global citizenship movement…identifying as members of the larger, human community,” said Alleyne. “The earth is our community. Accepting more responsibility as well as assuming more rights is what genuine freedom is about.” Alleyne provided ample information on second citizenships, and while the focus was on Dominica, she also shared the process and even broke down pricing in various other Caribbean destinations.

Belize played a central role in the discussion about banking, specifically regarding Caye International Bank in Ambergris Caye as well as in the discussion about real estate with ECI Development and its branded residences and tiny home development. Considered the best offshore bank in the world, Caye International Bank flourishes under Belize banking laws that require strict privacy and the highest liquidity ratio (24%) in the world. With this stability, Caye Bank draws clients seeking to protect their wealth and assets. On hand to share the history and various services offered at Caye Bank were the bank’s president emeritus and director, Peter Zipper, as well as its senior vice president, Luigi Wewege in addition of course to the bank’s chairman, attorney Joel Nagel.

Additionally, Belize was the draw during a dynamic presentation by Mike Cobb, CEO of ECI Development. With its motto of delivering inspired residences for adventurous souls, ECI has expanded throughout Latin America, seeking the locations that clients desire and forming incredible communities built to North American standards. By creating new home bases for those seeking to expand their assets overseas, while living a life of freedom at a substantially lower cost, ECI has made its mark on a corner of the real estate market created by demographics, scarcity, and in more recent times, panic. By introducing branded residences to the market in Belize, backed by the current and projected growth of the tourism industry, the value of the company’s assets can only continue its upward trajectory. The tiny home movement has also landed in Belize, with ECI’s TES Village, an eco-friendly, smart community featuring over-the-water tiny homes and residences on the bay side of Ambergris Caye, the country’s hottest tourism destination. As ECI has expanded this community concept throughout other locations in Central America, it continues to set the standard for real estate development in the region.

Joel Nagel at the Helm

When it comes to wealth preservation, knowing where tangible assets and investments can be protected and grow is vital. Joel Nagel’s decades of experience, which include serving as Belize’s ambassador to Austria, leading a delegation to Iowa on behalf of Belize, and establishing the Belize Academy of the Performing Arts together with Belize’s former Governor General Sir Colville Young, complement his ability to bring together a high caliber of speakers who are eager to share a vast array of knowledge in an intimate setting. Guest Mark Boyert said it best, “Investing and planning for your future cannot be done across the internet. It has to be done in person…You come to these conferences, and it’s hard to determine who the smartest man in the room is. There are some amazing presenters and there’s also some amazing people in attendance…[but] I’d have to give the nod to Joel, because he was smart enough to pull everyone together.”

When it comes to wealth preservation, knowing where tangible assets and investments can be protected and grow is vital. Joel Nagel’s decades of experience, which include serving as Belize’s ambassador to Austria, leading a delegation to Iowa on behalf of Belize, and establishing the Belize Academy of the Performing Arts together with Belize’s former Governor General Sir Colville Young, complement his ability to bring together a high caliber of speakers who are eager to share a vast array of knowledge in an intimate setting. Guest Mark Boyert said it best, “Investing and planning for your future cannot be done across the internet. It has to be done in person…You come to these conferences, and it’s hard to determine who the smartest man in the room is. There are some amazing presenters and there’s also some amazing people in attendance…[but] I’d have to give the nod to Joel, because he was smart enough to pull everyone together.”