On July 28th, the Belize Chamber of Commerce and Industry (BCCI), in collaboration with the Business Tax Department, hosted a pivotal business tax presentation. Held at the Sunbreeze Conference Room in San Pedro Town, the session aimed to provide clarity and guidance on tax regulations and compliance for local business owners. Attended by representatives from various sectors, the event focused on digital transitions, mandatory documentation, and the urgent need for timely tax submissions.

Presenters emphasized the new submission process, now in effect, which requires businesses to maintain up-to-date and accurate records. Employers must now ensure that tax identification numbers are on file for all employees, supported by appropriate documentation. This step is considered essential, as failure to submit required data on time may result in corrective measures, including fines.

The session also highlighted the importance of properly preparing and submitting employment tax forms, particularly the newly introduced TD4 form, for all employees regardless of their employment status. Maintaining accurate records was stressed as a key part of supporting the transition to digital systems, as the department continues to optimize its operations for online processing. Digital forms are available through the official website, making the process more efficient and accessible for businesses and individual taxpayers alike.

Speakers addressed the legal responsibilities of business owners under the evolving tax framework, stressing that ultimate accountability lies with the business operator. Owners were encouraged to routinely audit their accounts to ensure full compliance, as any discrepancies or late submissions are the responsibility of the employer. This heightened oversight is intended to reduce errors and enforce compliance at all levels of business operations.

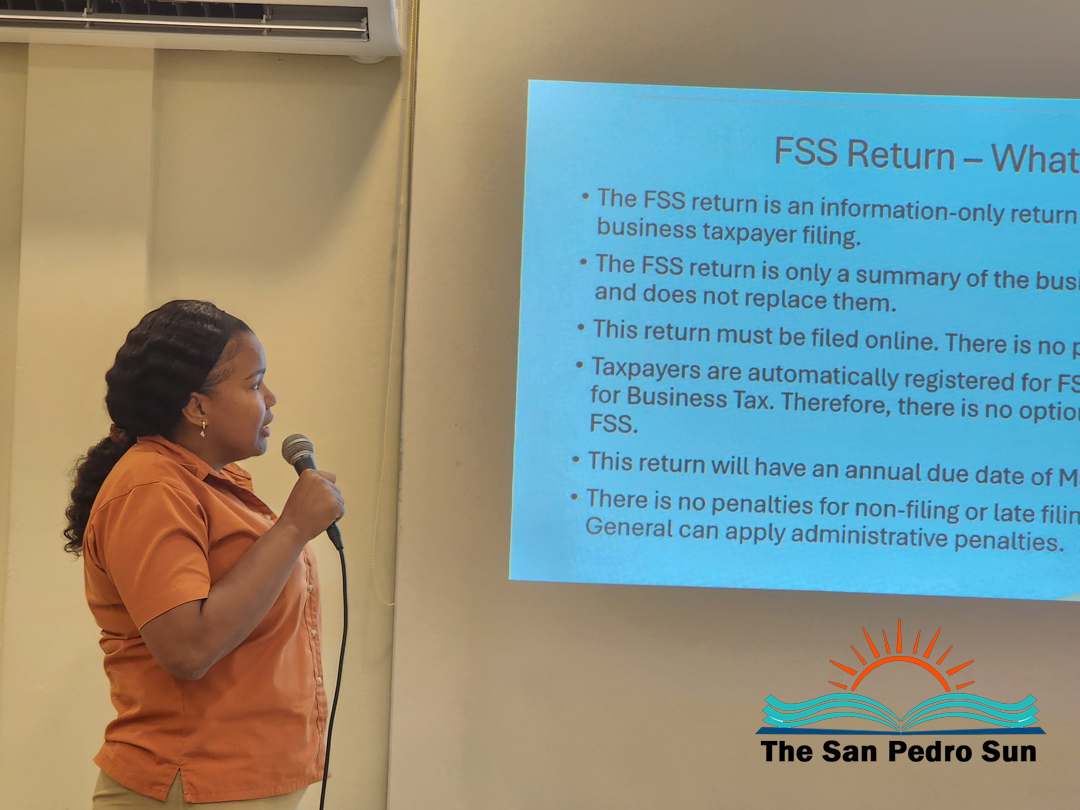

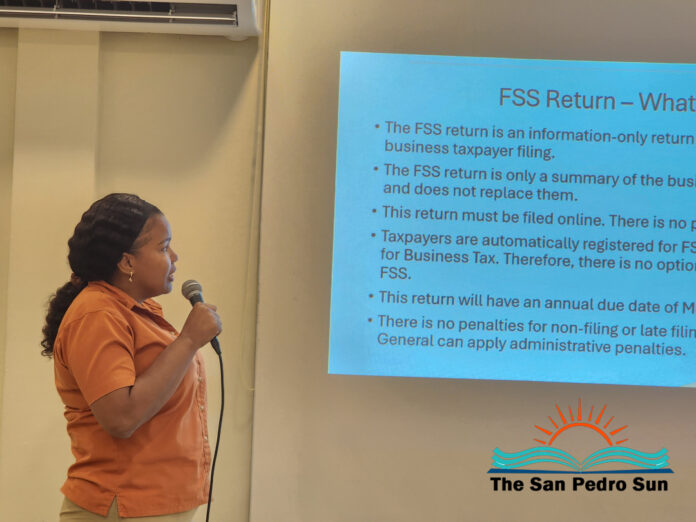

The presentation also detailed the recently mandated online filing system for financial statement returns. Businesses registering for a Business Pass are now automatically enrolled in the financial statement return regime, with paper submissions no longer accepted. The deadline for filing the 2024 return has been extended to December. This transition aims to streamline risk analysis and promote data-driven decision-making across the business community.

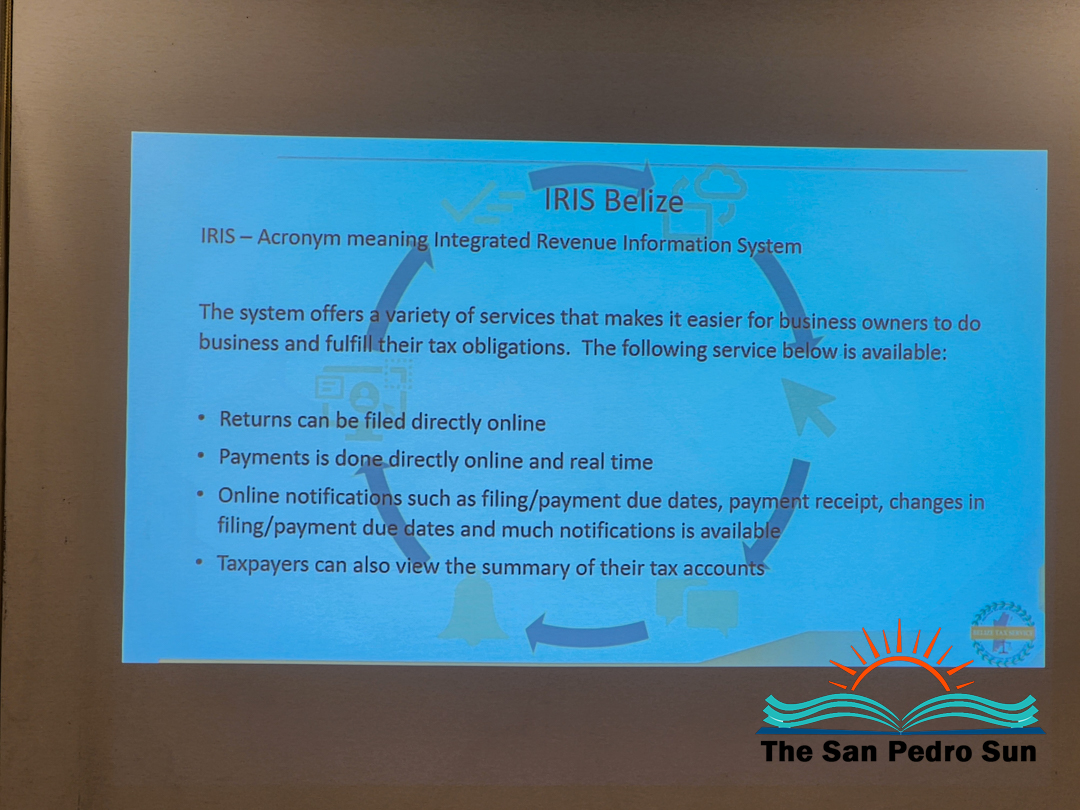

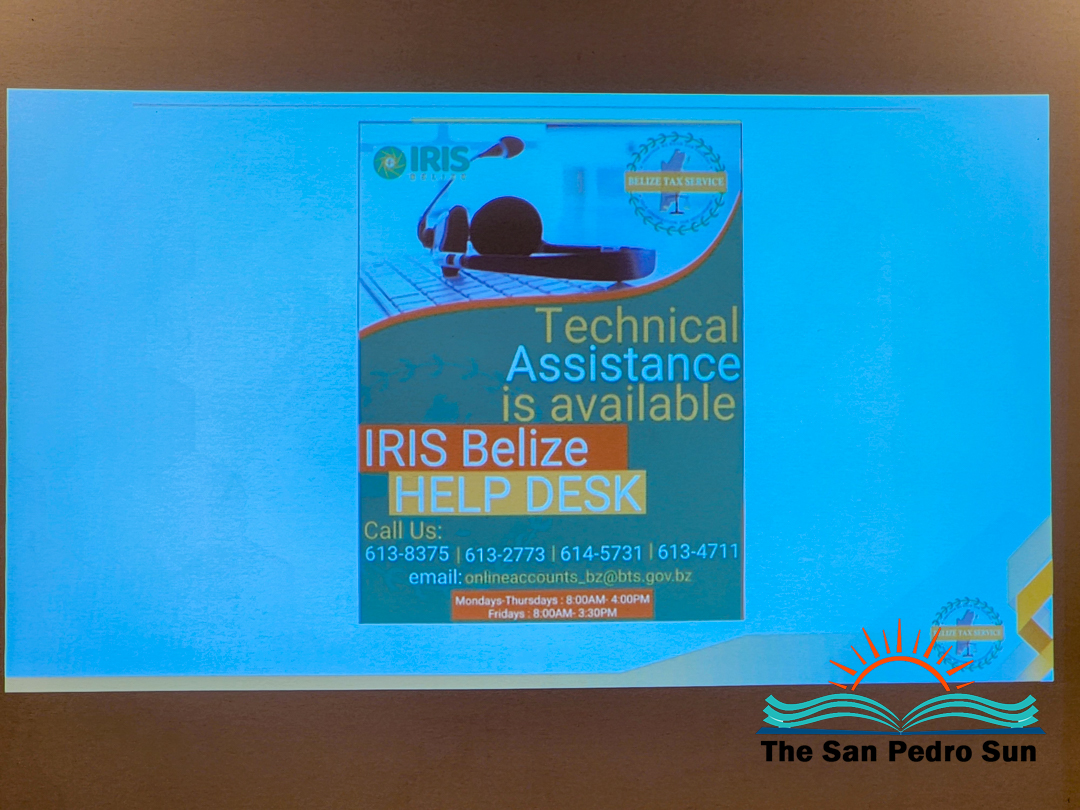

To support businesses through this digital shift, the session included practical demonstrations of the IRIS online system. Attendees were guided through the digital submission process and introduced to built-in tutorials and in-office assistance. A suite of support tools, including help videos and technical guidance, was presented as essential resources for adapting to the new digital landscape.

Additional topics covered included proper account reconciliation, record retention requirements, and the importance of notifications and reminders for upcoming deadlines. Attendees were also introduced to new support systems, including message-based communication and live assistance, provided by both the BCCI and the tax department, designed to ensure that questions and concerns are addressed promptly.

The San Pedro event is part of a countrywide awareness campaign aimed at ensuring both employers and employees understand the new digital systems and compliance protocols that have been implemented.

Share

Read more