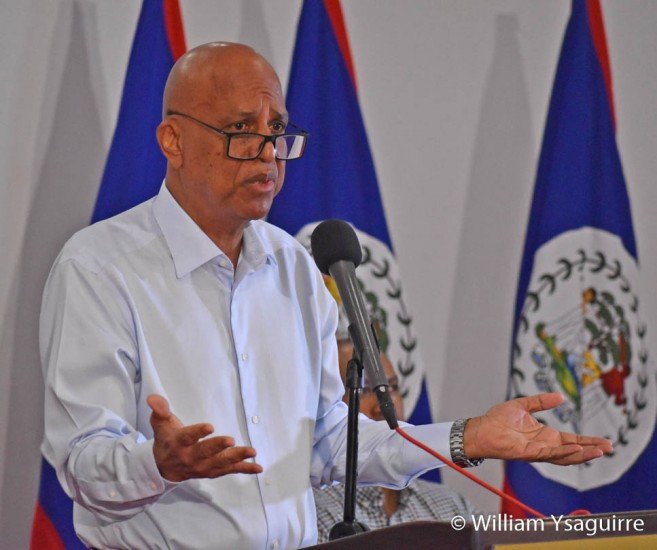

According to Prime Minister Hon. Dean Barrow, the people nor the Government of Belize (GOB) are liable in the Sanctuary Bay land scam carried out by U.S. convicted felon Andris Pukke, who from behind bars defrauded United States investors out of millions of dollars with promises that they were buying into land development in the Sittee River area of southern Belize. At a press conference at the Ramada Princess Hotel and Casino in Belize City on Wednesday afternoon, July 9th, P.M. Barrow emphatically stood behind his claim.

The Atlantic International Bank Ltd (AIBL) was the unwitting and unfortunate ‘fall-guy’ in the scheme, for while less than five percent of the proceeds of the scam were processed through AIBL, the bank was forced to close its doors when the U.S. Federal Trade Commission (FTC) began legal proceedings against AIBL for allegedly having “aided” Pukke in perpetrating his scam. The FTC’s civil lawsuit caused all U.S. banks affiliated with AIBL to abruptly severe their correspondent banking relationship as AIBL became toxic. This completely blocked the AIBL’s ability to conduct business, since all its deposits and loan transactions were in U.S. dollars. The scandal also caused the Central Bank of Belize to revoke AIBL’s banking license on April 12, 2019, at which the FTC moved swiftly to freeze all AIBL’s assets based in the U.S.

P.M. Barrow called the press conference to clear the air and give the lie to many scurrilous claims made by Pukke’s attorneys in a filing before the Federal Trade Commission, which was then publicly disseminated by the U.S. media. Barrow was at a loss to explain why the FTC gave any credence to allegations made by a convict who “clearly would sell out his own mother to weasel his way out of paying for his crimes,” but Barrow sought to give a true account to the many false allegations made in the filing.

The AIBL legal team had sought bankruptcy protection under U.S. Chapter 15 in the Florida USA Bankruptcy Court, which would have established the recognition of the Belize liquidation process under U.S. law and protected the estate flows through the U.S. banking system, but the FTC opposed this recognition.

Pukke’s filing alleged that he had met with P.M. Barrow in August 2014 and that a White Paper was submitted to Cabinet regarding the Sanctuary Bay development. “Nuttin no go soh,” Barrow was at pains to clarify, and he made this point in no uncertain terms to the U.S. Chargé de Affaires Keith Gilges at the U.S. Embassy when he became aware of the filing. Gilges apologized and bucked the complaint up to his superiors at the U.S. State Department, to be relayed to the FTC. At the press conference, Barrow reaffirmed that he had never, ever met Pukke, and in all the Cabinet meeting which he had chaired from 2014, no such White Paper had ever been introduced, not so!

The Pukke filing also alleged that P.M. Barrow owned land in the Sanctuary Bay development. P.M. Barrow’s name does not appear on the list of landowners or investors, but Pukke’s attorneys got around this by suggesting that the land may be in the name of another family member, or a business associate, since the Prime Minister’s law firm Barrow & Williams had represented the Sittee River Wildlife Reserve, which had owned the 14,000 acre property involved in the Sanctuary Bay scam. It mattered not to them that P.M. Barrow has not been a practicing attorney in his law firm since being elected Prime Minister in 2008, not that Barrow & Williams had withdrawn as the Sittee River Reserve attorneys from November last year.

Pukke’s filing also accused Minister of Economic Development Hon. Erwin Contreras of being an “engineer” involved in the Sanctuary Bay development. The Sanctuary Bay ‘developers’ had, in fact, employed another Erwin Contreras, who was not the minister, and this individual communicated with the minister regarding the name error, when the news broke. But Pukke’s attorneys had qualms in making such a deliberate name recognition error, besmirching the good name and reputation of Minister Contreras – guilt by association, as it were.

The Atlantic International Bank Ltd (AIBL) is the unfortunate and unwitting ‘fall guy’; for although as little as two percent of the proceeds of the Sanctuary Bay scam was funneled through AIBL, they are left carrying the bag. Barrow said the FTC would be well-advised to go after the other U.S. banks who handled over 95 percent of the money. But the FTC freeze of AIBL’s U.S. assets forced the bank to seek an out-of-court settlement, as their only hope of getting out from under this false accusation, is to liquidate the bank’s assets to return the depositors’ assets. But since the bank’s loan assets and loan repayments were in U.S. dollars, it urgently needed to restore correspondent banking privileges with U.S. banks, or the loan assets would devalue, and the depositors would only lose by their liquidation.

AIBL liquidator Julian Murillo explained that under the negotiated settlement the FTC has backed off, by moving for a stay of proceedings for 60 days, and lifted the freeze of AIBL assets. The AIBL assets were only partially frozen when the FTC began its civil proceedings that AIBL had violated certain U.S. laws by “aiding the principal American perpetrator of the Sanctuary Belize retirement home, real estate development. But with the revocation of its banking license, AIBL’s assets in the U.S. were completely frozen.

Murillo said AIBL was under pressure to settle even though the bank had admitted to no wrongdoing, nor had any court ruled that it was guilty, but a reasonable settlement was expedient. The main reasons Murillo cited were:

a) First, the ability to dispose of the bank’s loan portfolio, which represents 70% of AIBL assets, is a material factor for prospective purchasers.

b) Secondly, Murillo was concerned about the costs of an extended legal battle with the FTC in US courts. AIBL management had already spent almost $4 million on legal costs up to the point of liquidation, which continued to rise even after and would now be paid by depositors and creditors.

c) Third, as AIBL’s loan repayments are in U.S. dollars, which must be processed through U.S. correspondent banks, and the asset freeze and loss of correspondent banking privileges had impaired the flow of loan repayments. The quality value of the loan portfolio would deteriorate until the banking privileges were restored

The liquidation process of AIBL’s assets will take at least another six months, Murillo said, and he does not expect it to complete before January 2020. Full details of the settlement would be forthcoming after the FTC signs off and approves the settlement. Neither Barrow nor Murillo hinted at how much the AIBL investors would receive back in cents on the dollar.

Is there anyone who did not take a hit from the scandal? Former Central Bank Governor Glenford Ysaguirre had written an informal memo to the then Director of the Financial Intelligence Unit, Joy Grant, that the AIBL transactions suggested there “might” be some money laundering involved. Present Central Bank Governor Joy Grant declared she indeed had received this communiqué from Ysaguirre on September 26, 2018, just four days before she took up her new appointment as Central Bank governor. But neither the Central Bank nor the AIBL was involved in regulating land transactions; both institutions only handled money matters. She said neither institution was responsible for investigating or controlling an illicit land scam that was taking place between U.S. citizens, in the U.S. jurisdiction.

Senator Aldo Salazar was also an attorney for AIBL in its fight against the FTC litigation, but Barrow made no move to defend him. On this issue, Barrow said, Senator Salazar is not a minister and not part of the GB executive, but as a seasoned attorney, he was sure Salazar could handle himself.

Share

Read more