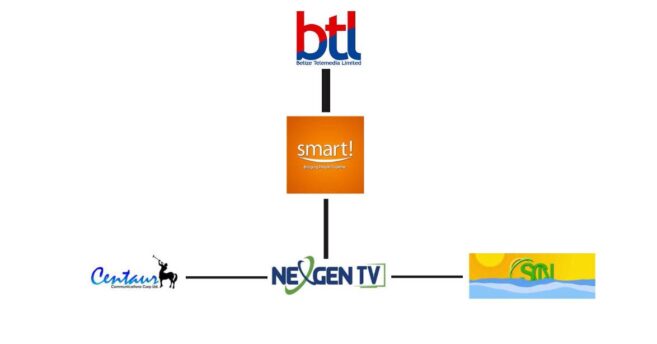

Following an announcement on January 9th that Belize Telemedia Limited (BTL) was considering the acquisition of SMART, along with cable companies Centaur Communications and CTI/NEXGEN, the proposed consolidation is now uncertain. This follows the cable companies’ withdrawal from negotiations amid increased public and media scrutiny. The proposed deal may now proceed with SMART included only.

Centaur Communications was the first to announce its withdrawal from the negotiations. In a letter addressed to BTL Chairman Markhelm Lizarraga, the company stated that its decision was not based on a reassessment of the business rationale or valuation, but rather on broader external and political considerations. The letter further noted that continued negotiations would impose disproportionate personal and reputational burdens.

On January 12th, CTI/NEXGEN issued a similar statement announcing its withdrawal. The company said that while the consolidation could have provided fair value and served the interests of BTL, its shareholders, and the Belizean economy, recent developments, including personal and reputational attacks unrelated to the commercial terms, prompted its decision to step away from negotiations. As both companies jointly own the Southern Cable Network, that entity is also expected to be excluded from the proposed deal.

The withdrawal of the cable companies removes approximately $90 million from the reported $170 million acquisition package initially under consideration by BTL. With only SMART remaining, the proposed acquisition is now valued at approximately $80 million.

Lord Michael Ashcroft’s office issued further statements. A press release dated January 12th clarified that the sale of the cable companies was not linked to the potential acquisition of SMART. According to the release, the Waterloo Group Charitable Trust owns 77% of SMART. In comparison, the remaining 22.5% is owned by members of Prime Minister John Briceño’s family, 16.73% by Jaime Briceño, and 5.77% by Renan Briceño.

The release further stated that a combined operation of SMART and BTL is projected to significantly increase BTL’s annual cash flow, potentially enabling a four-year financial payback.

The proposed acquisition has drawn intense criticism, with concerns that it is not in the best interest of the Belizean public. The Government of Belize is the majority shareholder in BTL, and critics argue that if the deal proceeds, the Briceño family would receive approximately $18 million, with the remainder going to the Ashcroft alliance.

During BTL’s January 9th press conference, Chairman Lizarraga declined to specify the total cost of the proposed acquisition but defended the rationale behind it. He cited rapid global digital changes and the need for adaptation within the telecommunications sector.

“There is a need to change and adapt,” Lizarraga said. “BTL is an essential service, playing a significant role in the economy, communications, and national security. We must remain modernized, strengthened, and continuously reinvesting.”

Lizarraga also stated that Belize’s telecommunications sector is overcapitalized, citing duplicated infrastructure, such as multiple cables and billing systems. “All that amount of cable is unnecessary when all that service can be transmitted through one cable. That is inefficient, costly, and ultimately paid for by consumers,” he said. He added that BTL invests up to $35 million annually in system redundancy to ensure reliability.

Despite these explanations, public resistance remains strong, with many consumers expressing concern that the acquisition would create a monopoly. Critics have also pointed to the lack of public consultation and perceptions that the transaction would primarily benefit a small group of stakeholders.

Opposition from the United Democratic Party (UDP) has been vocal. The party said it does not support monopolies and cited concerns raised by the Belize Chamber of Commerce and Industry and civil society organizations. The UDP called for safeguards before any decision, including independent valuation and due diligence, a ten-year viability outlook, a transition plan for market restructuring, and a national interest impact assessment. The party also urged meaningful stakeholder consultation and full public disclosure.

The proposed acquisition was also rejected by four independent senators, Kevin Herrera, Louis Wade, Glenfield Dennison, and Janelle Chanona. In a joint statement, they warned that the move could result in a telecommunications monopoly and aligned themselves with calls from the Belize Chamber of Commerce and Industry and the National Trade Union Congress of Belize. The senators demanded full public disclosure and said they are prepared to act collectively to block the acquisition if necessary.

At this time, no further updates have been provided regarding the possible acquisition of SMART by BTL. If approved, the deal would effectively leave Belize with a single dominant telecommunications provider.